Case Study: Designing the OLOC Restriction Workflow

Case Study: Designing the OLOC Restriction Workflow

Enabling Operational Resilience and Compliance through Scalable UX

Company: Ironcrest Bank

Role: Lead UX Designer

Tools: Figma, Lucidchart, Confluence

Platform: Internal Servicing

My Role

As Design Lead, I owned the full design execution.

I partnered with:

- Risk & Compliance

- Product & Ops

- Engineering

- Other Designers

The Problem

The legacy process involved:

- Frequent TRIPS outages

- Manual duplication of effort

- Spam and duplicate cases

- Inconsistent decision-making

- Compliance risks

Background

Some Ironcrest Bank customers experience financial hardships and hit Statute of Limitations (SOL). Although they want to continue their relationship with the bank—such as paying off balances or reopening accounts—the Overdraft Line of Credit Restriction (OLOCRES) process was outdated, inconsistent, and complex.

Customers frequently shared sentiments like:

"I want to use my account again, but it's restricted."

"I want to reopen or receive a deposit, but I'm blocked."

Internally, the TRIPS system—used by the Bank Customer Resiliency (BCR) team—was unreliable, causing compliance risks, slow handling, and duplicated efforts.

Discovery & Research

Agent Shadowing

Shadowed agents using TRIPS and spreadsheets

User Interviews

Conducted async interviews with BCR call center and back office staff

Pattern Analysis

Audited existing case submission patterns (spam, duplicate, incomplete cases)

Compliance Mapping

Worked with compliance team to capture the logic tree for waiver/refund eligibility

Key UX Contributions

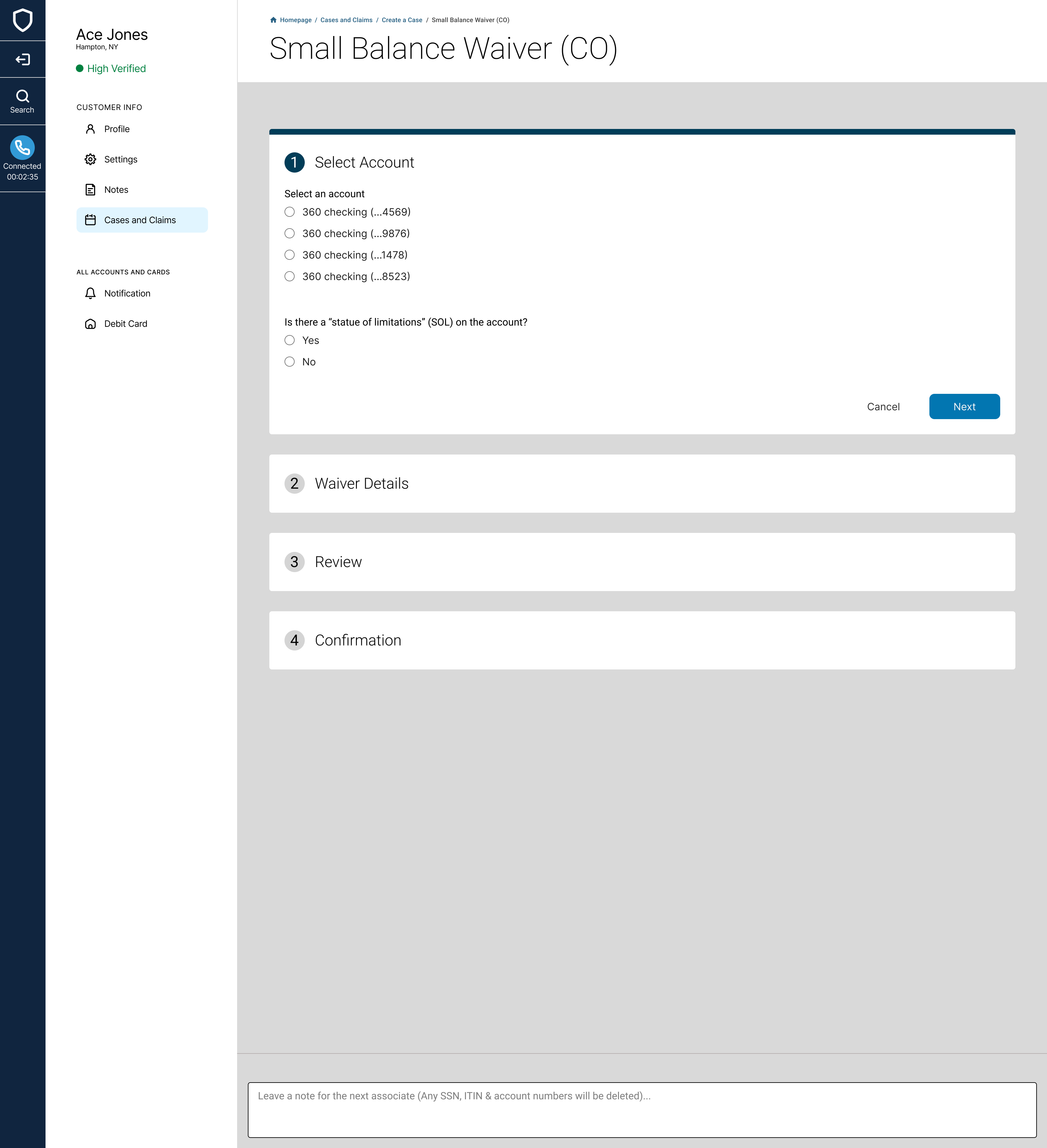

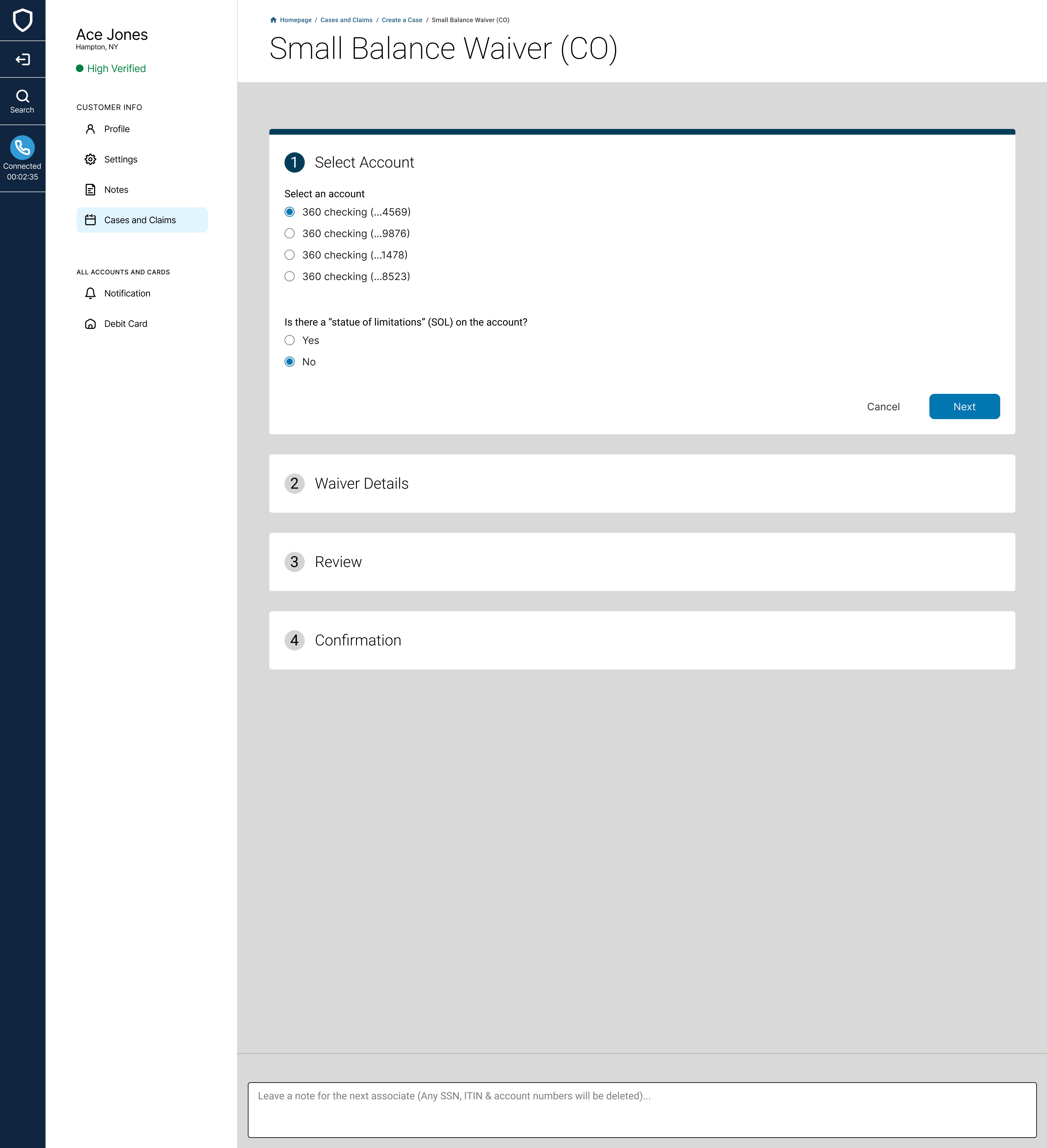

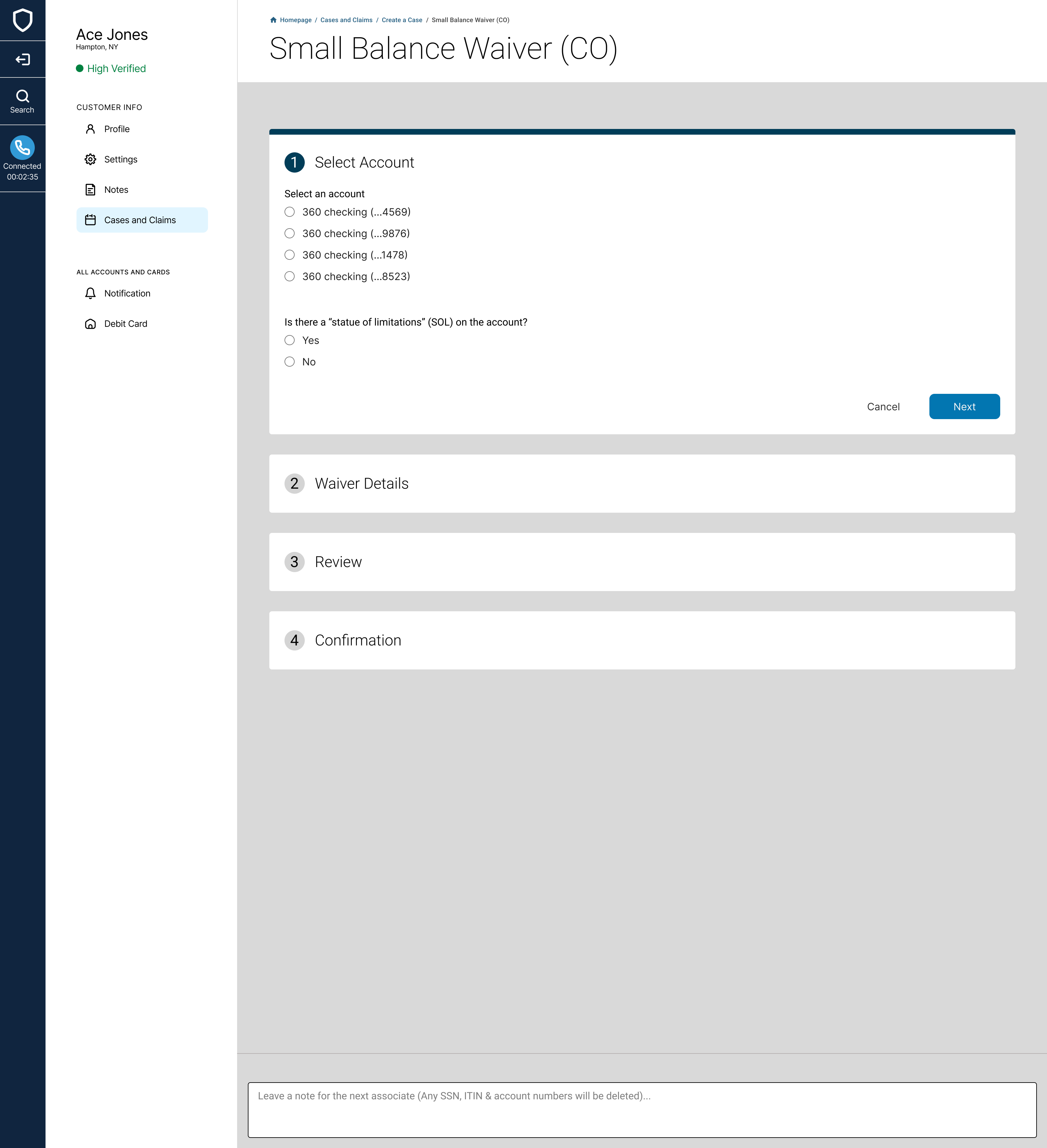

Logic-Driven Flow Design

I mapped out and embedded conditional logic into the workflow:

- OLOC-linked?

- Charge-off present?

- Bankruptcy flagged?

This reduced decision ambiguity and ensured agents followed the right process path.

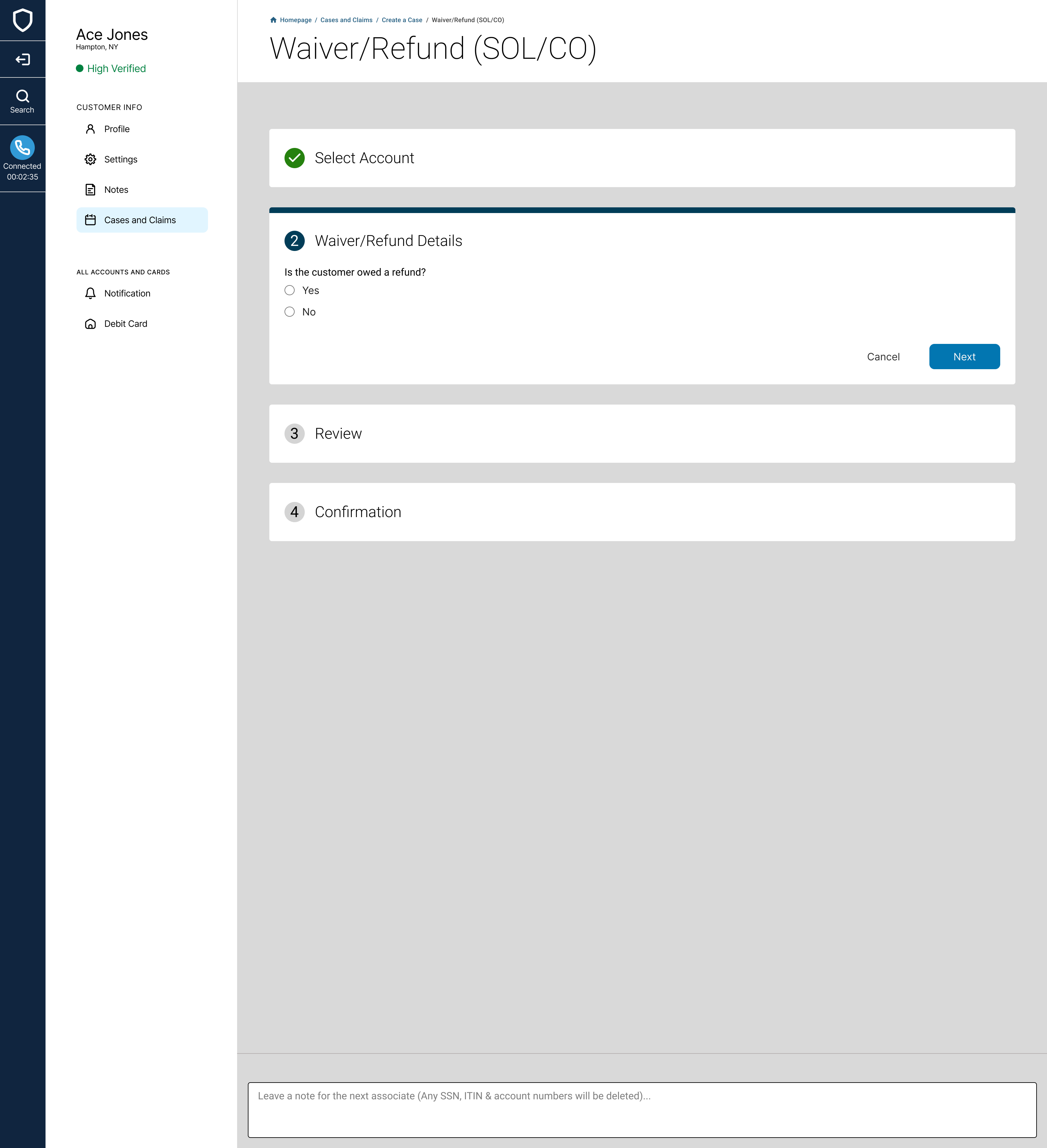

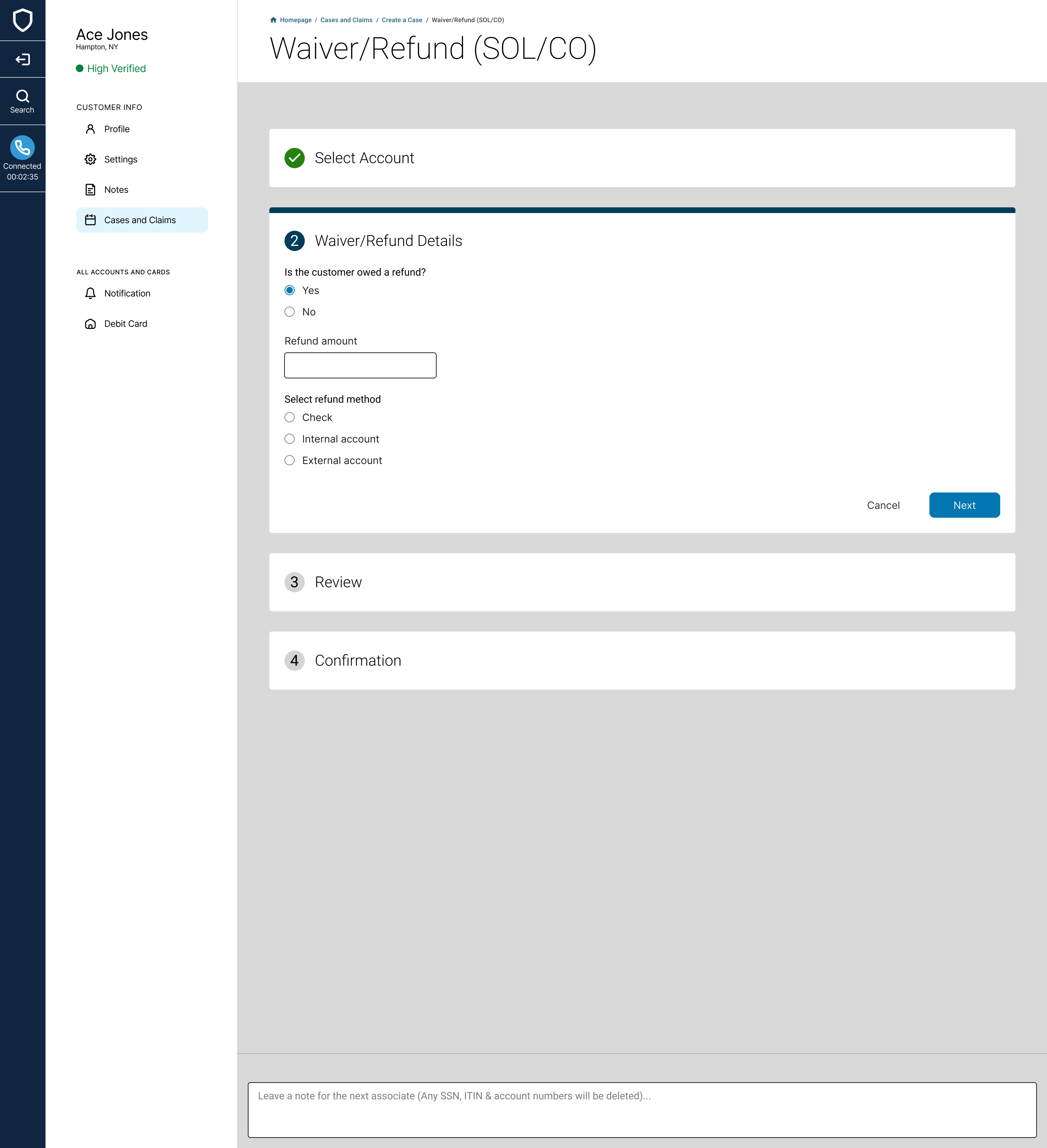

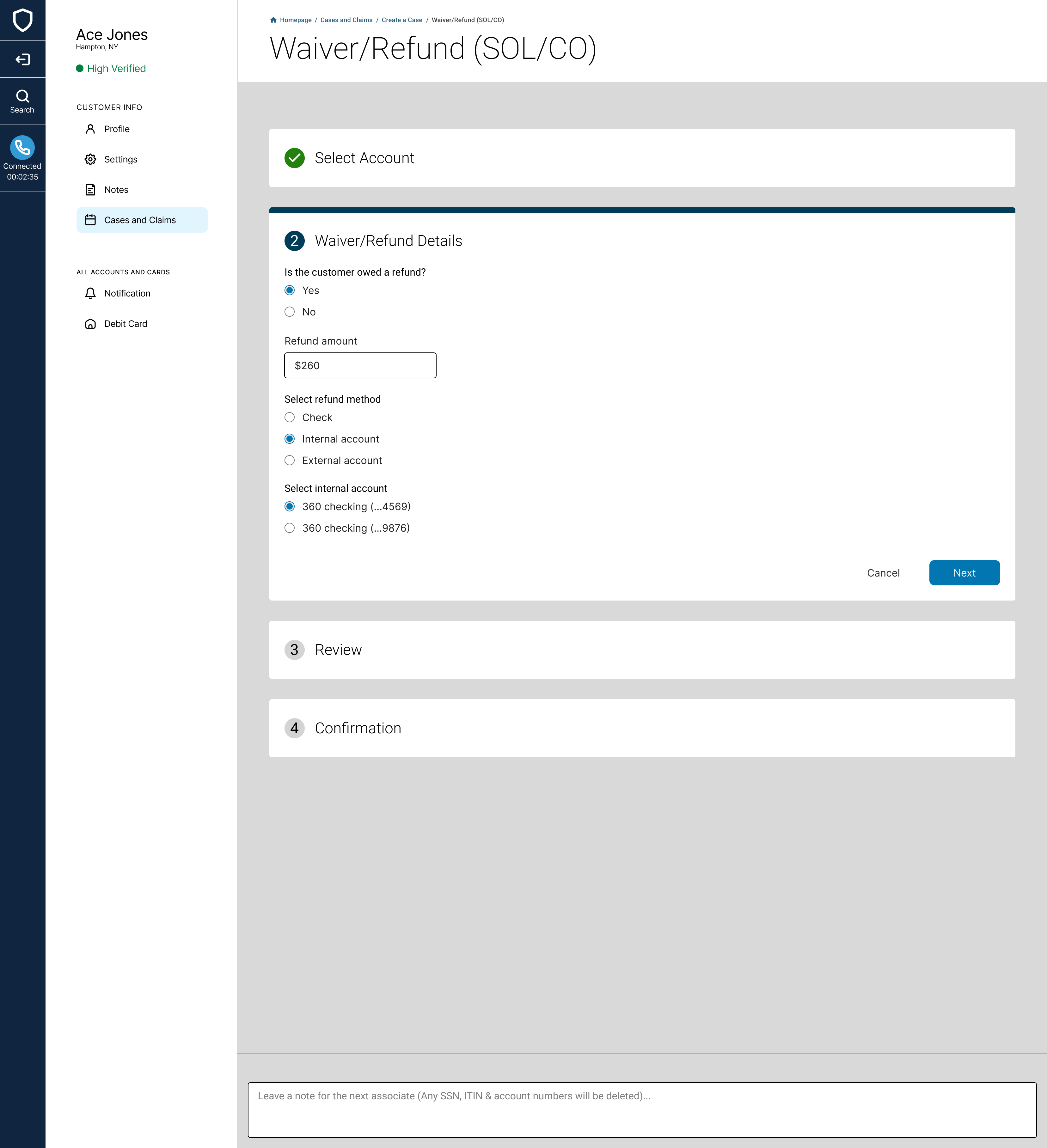

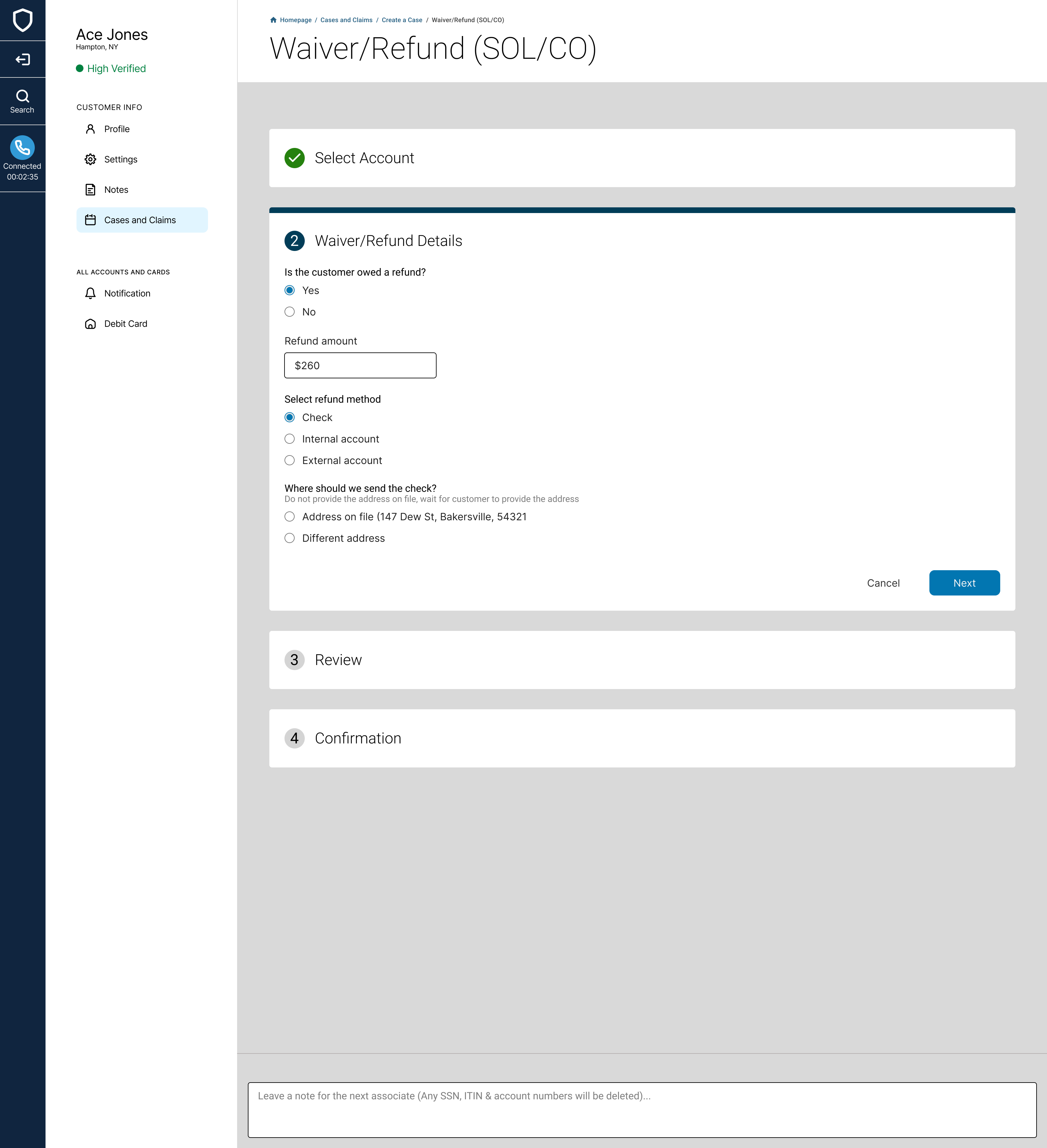

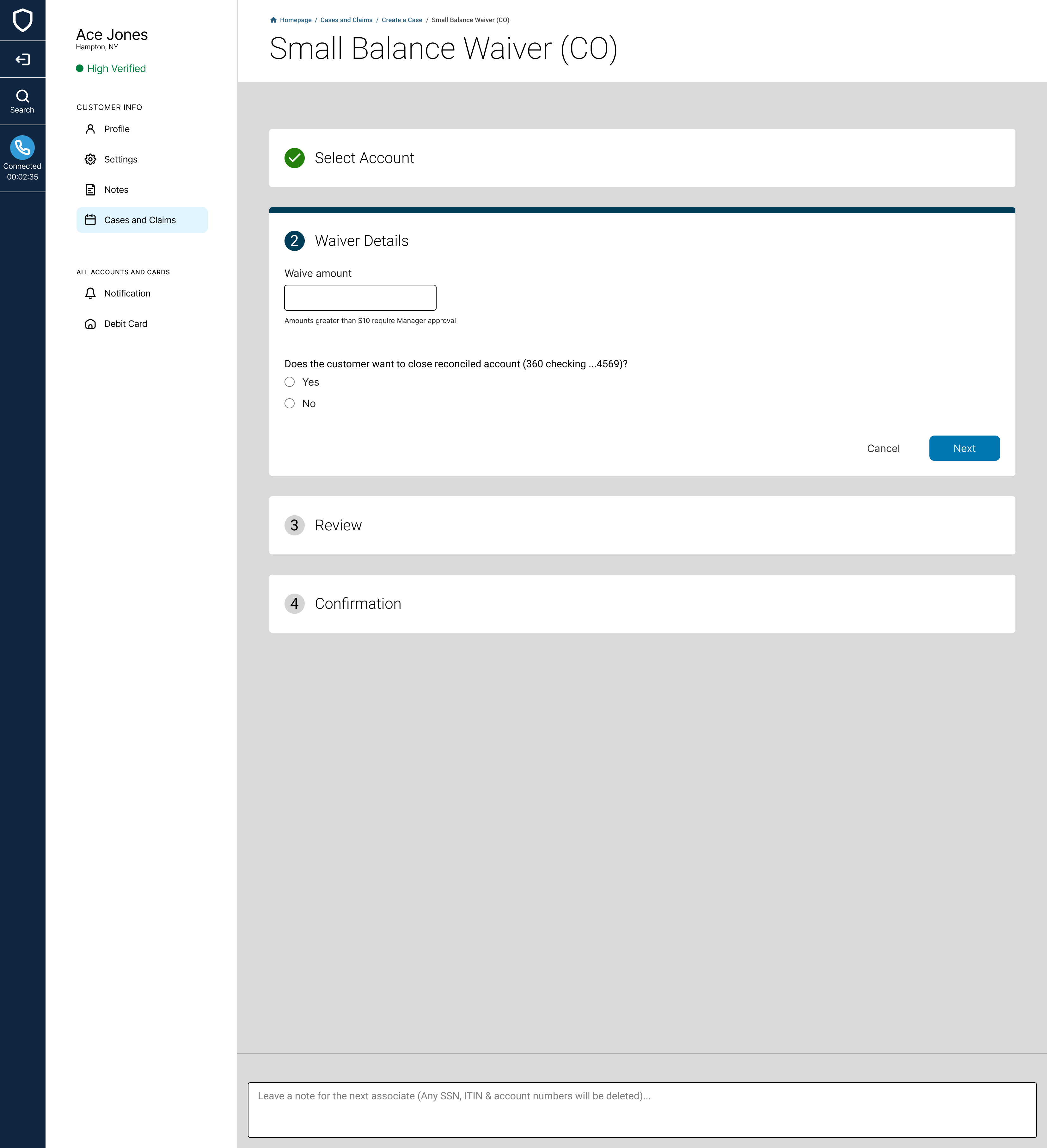

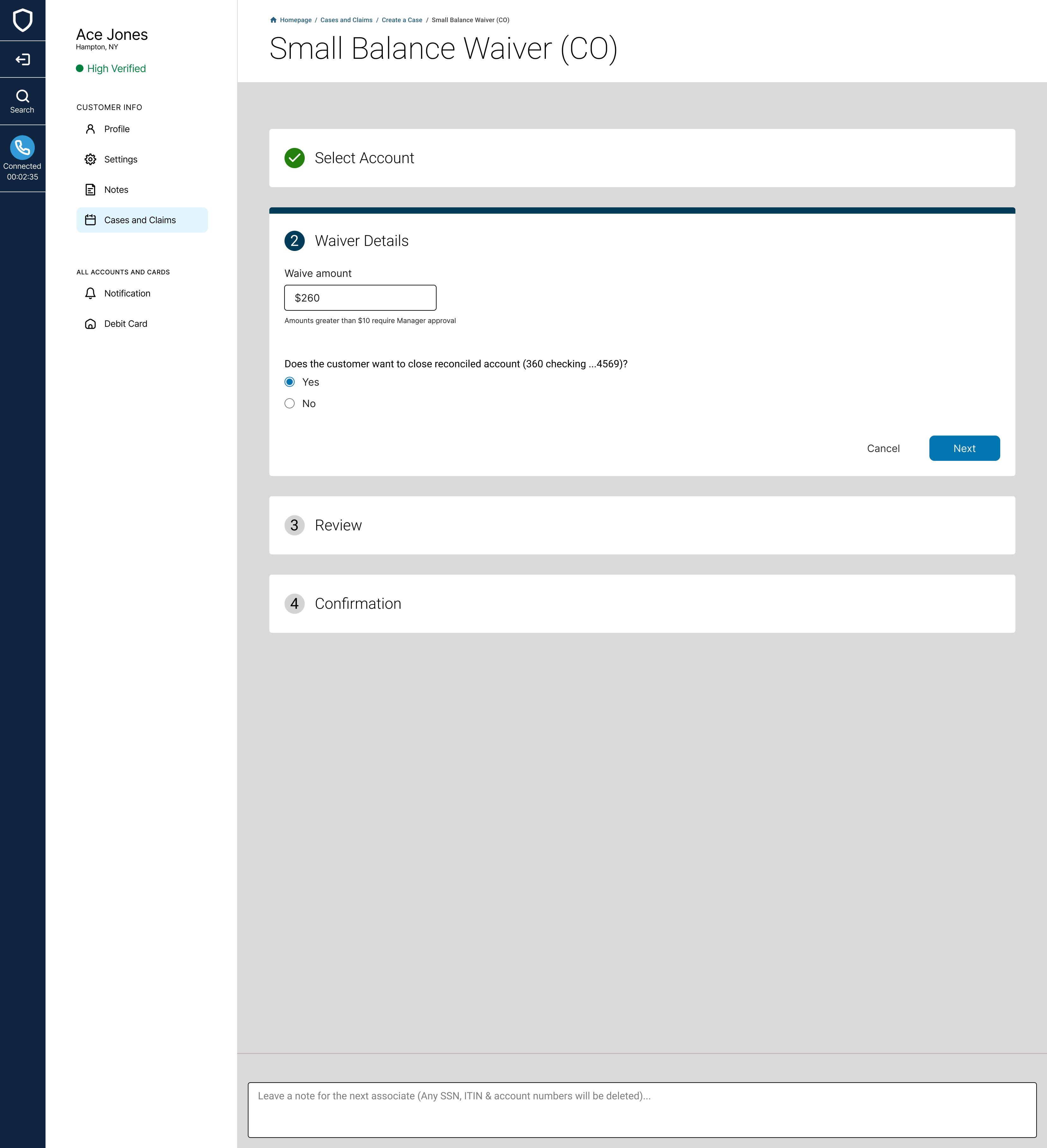

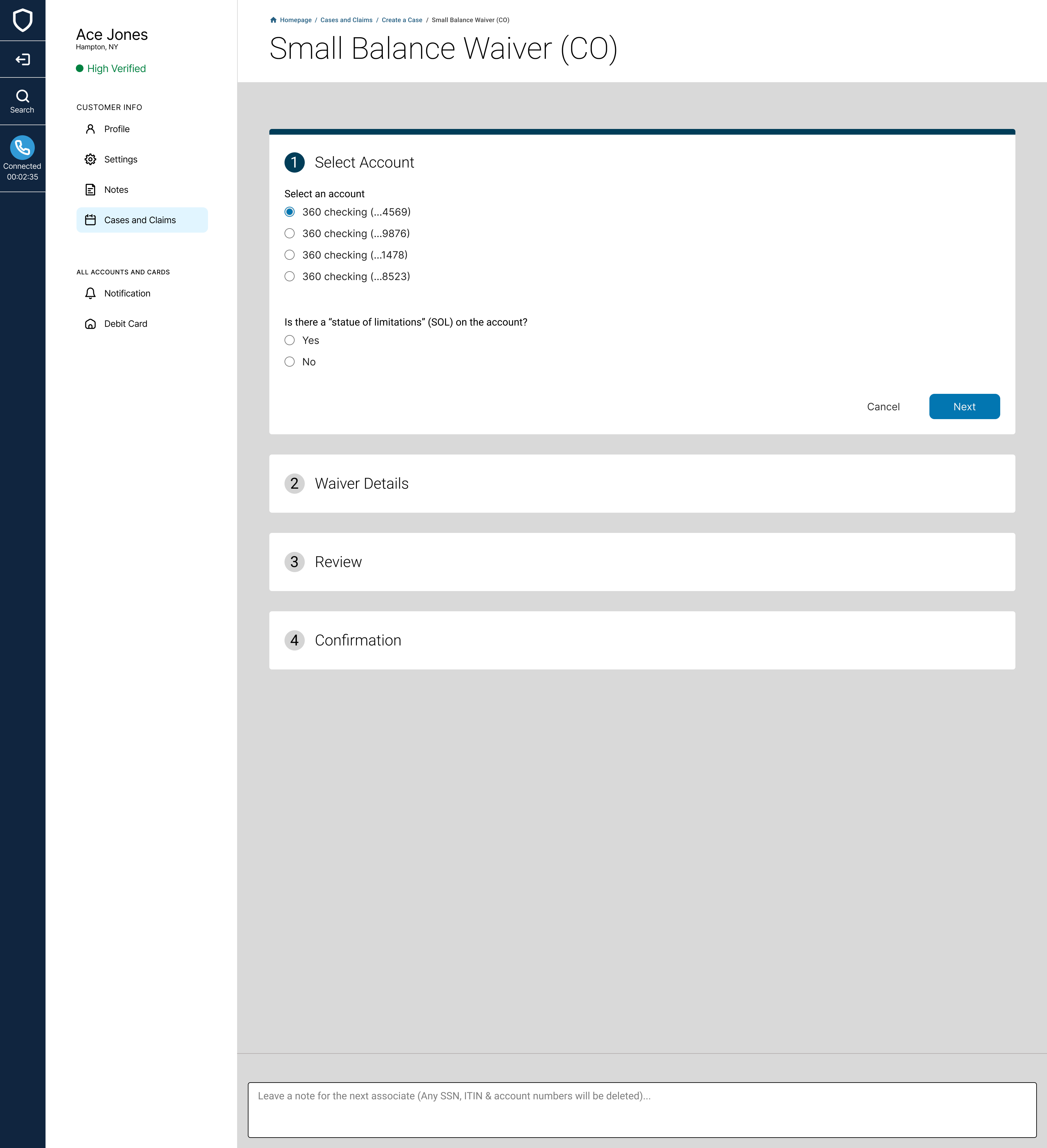

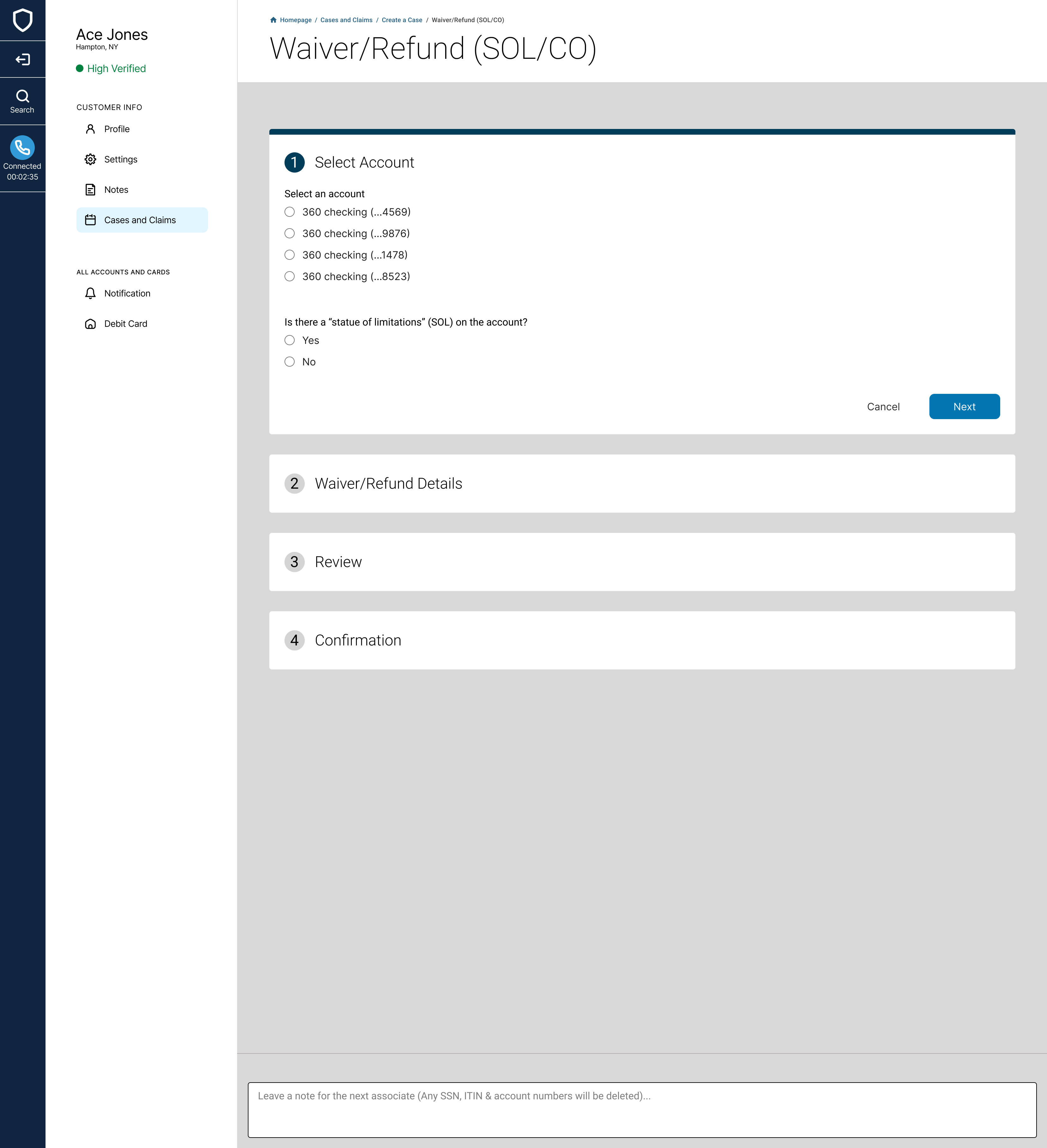

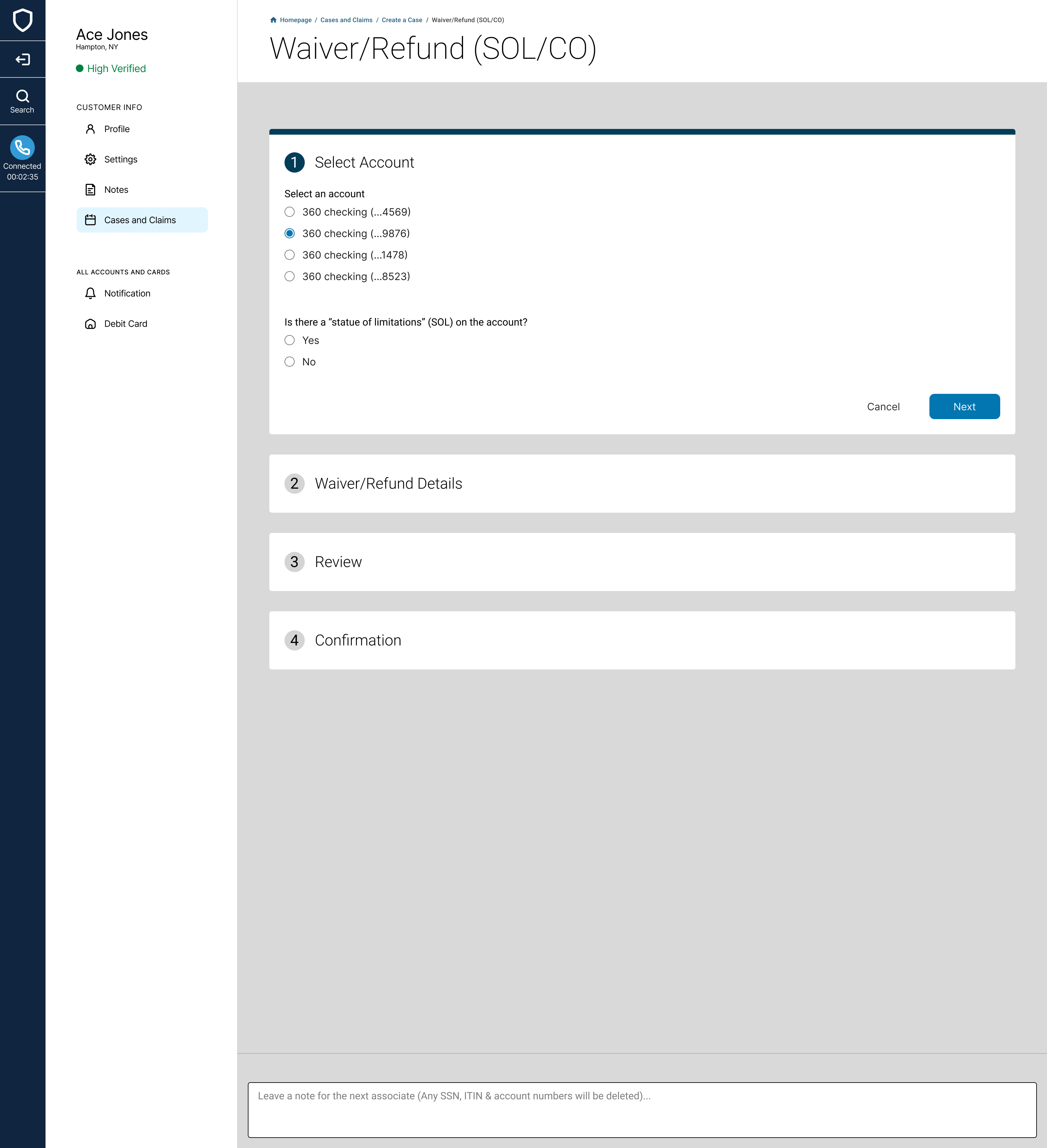

Smart Intake Form

The form dynamically revealed or hid sections based on account context:

- If account tied to bankruptcy or SOL → downstream options were disabled

- Relevant fields pre-populated where data was available

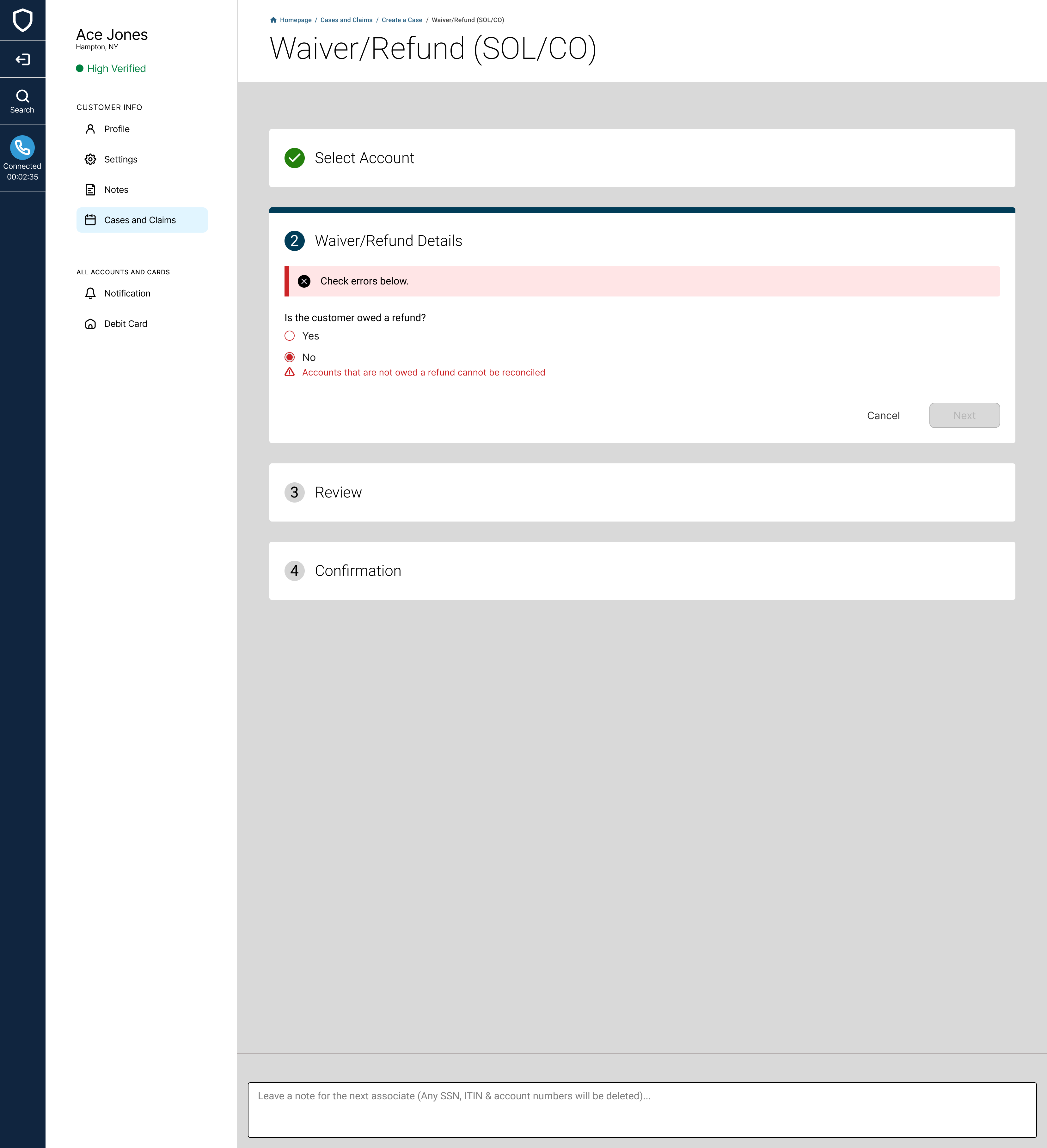

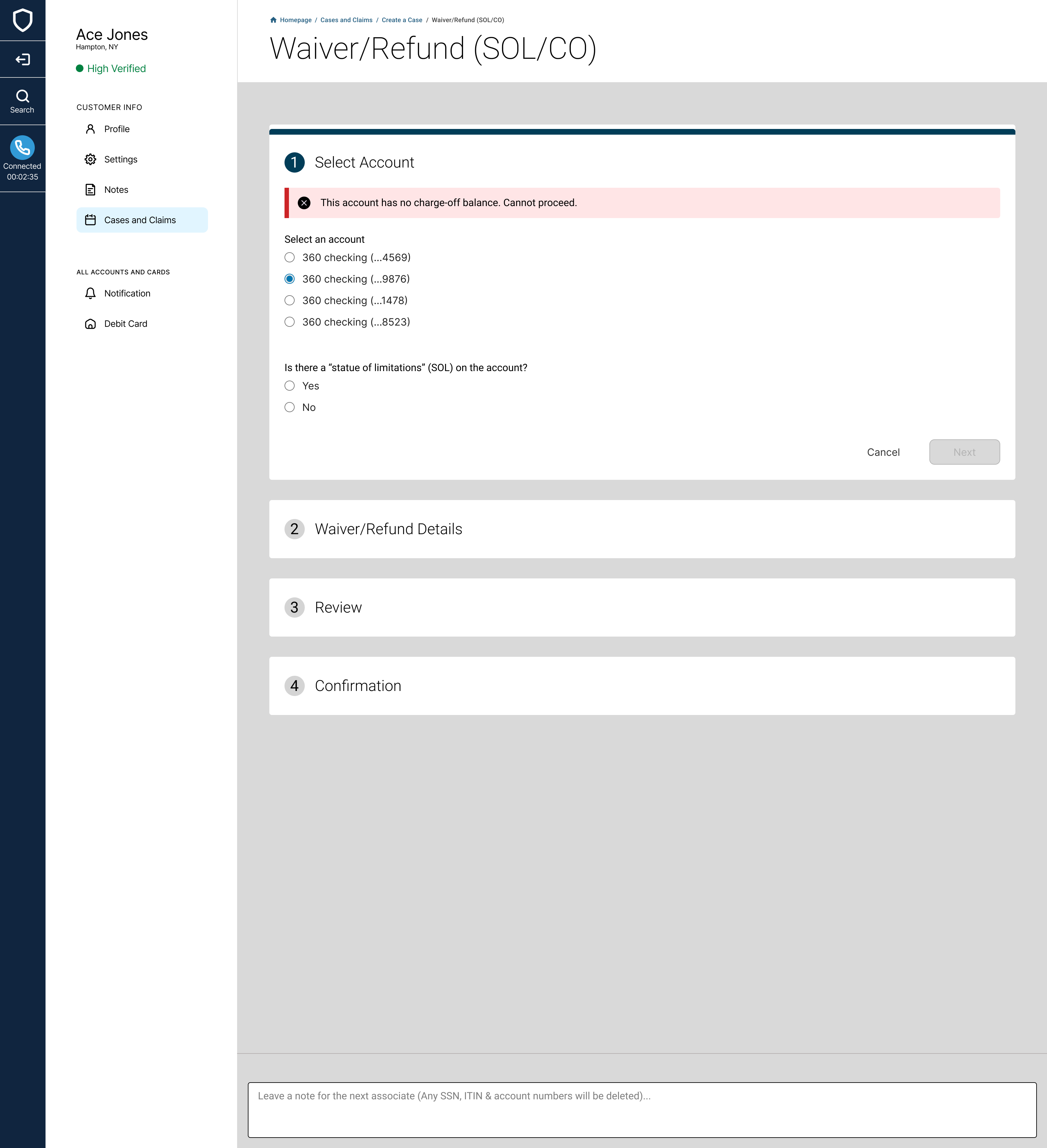

Visual Risk Flags

I designed visual cues (banners) to surface key risk indicators like:

- Bankruptcy involvement

- Address on file not matching

- Balance not being waived

Agents were prompted to pause, escalate, or reroute.

System-Aided Decisions

Where possible, I offloaded decisions from the agent to the system:

- Ineligible actions were blocked automatically

- Determining the eligibility status of each account

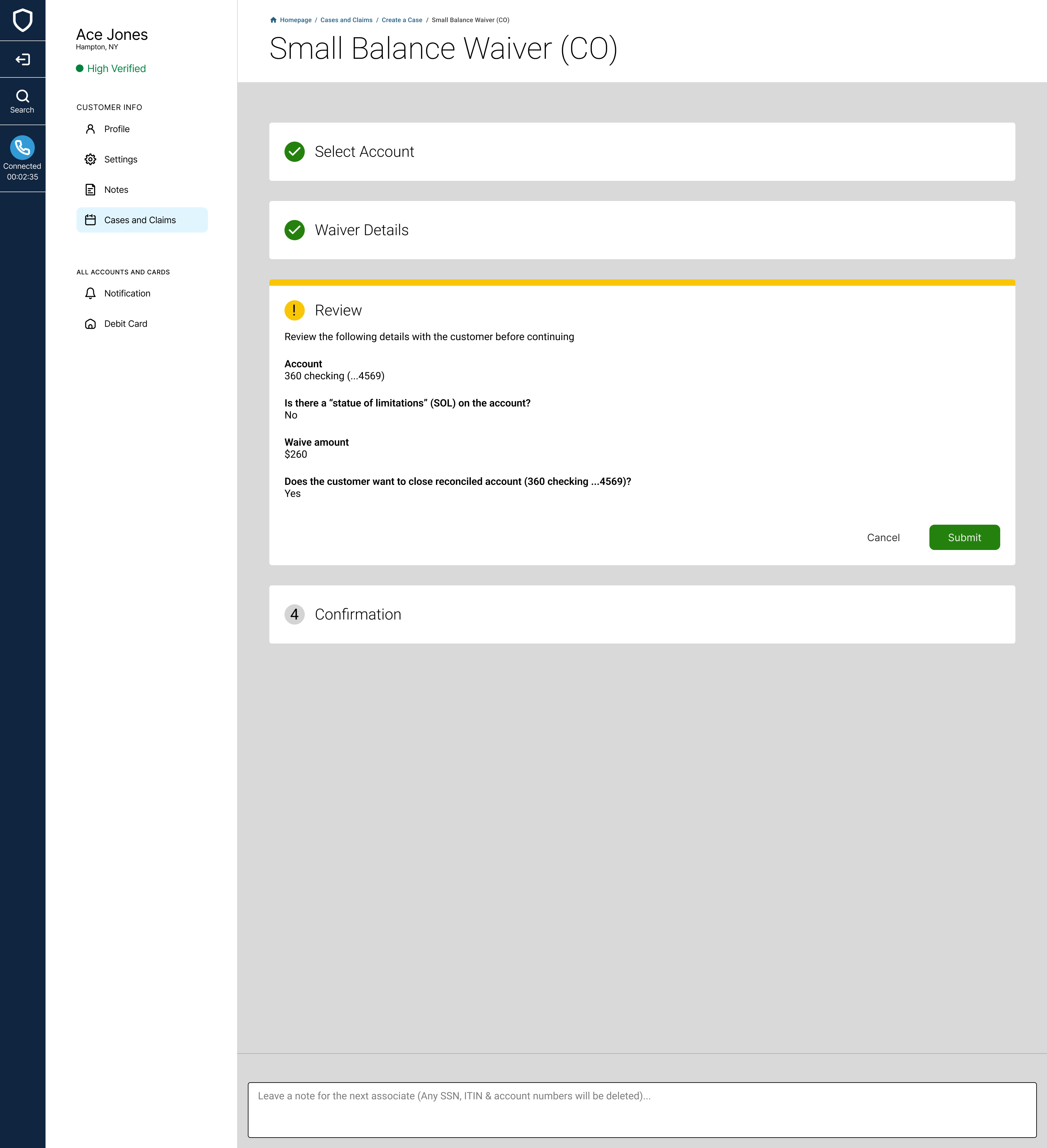

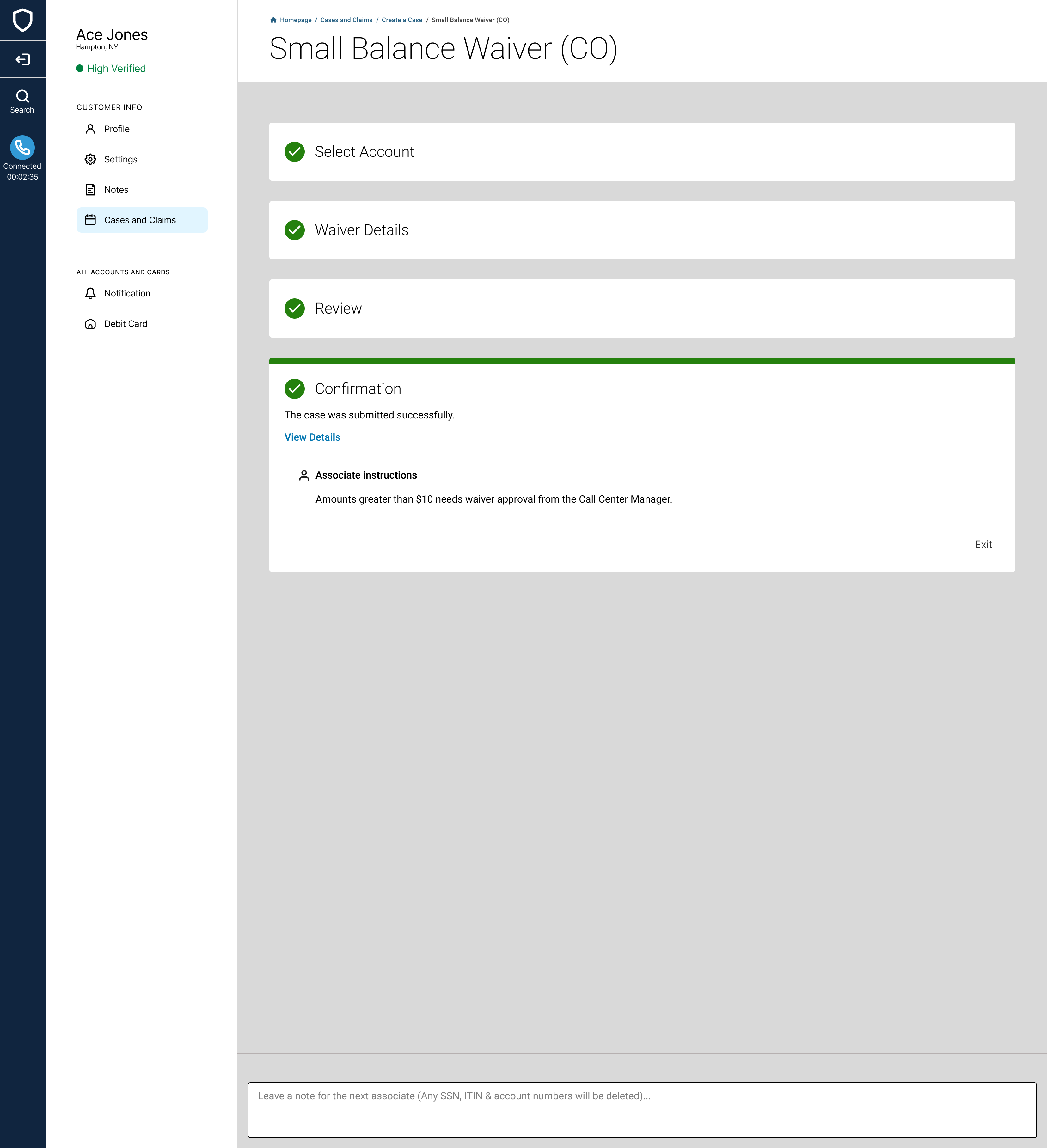

Confirmation & Audit Trail

A new summary screen offered:

- Case outcome confirmation

- Reference ID

- Notes for traceability and follow-ups

Final Workflow

Agent enters account number

System checks OLOC, SOL, bankruptcy, and flags

Logic determines eligible path (waiver/refund/deny)

Form updates dynamically → Agent completes intake

Final review screen → Submit

Case confirmation + reference ID + audit log

Additional Workflow Screens

No OLOC → Positive CO

Review.aa974e91.png)

Confirmation More Details.cc4d76e7.png)

Confirmation.2b425299.png)

Small Balance → No SOL

Small Balance → SOL

Unhappy Path: No OLOC → No CO

Results & Impact

The redesigned OLOC restriction workflow successfully addressed the key pain points identified in the legacy system. By implementing logic-driven flows, smart intake forms, and visual risk flags, we significantly improved agent efficiency and reduced compliance risks. The new system eliminated reliance on spreadsheets and email-based submissions, while enhancing auditability and case tracking capabilities.

| Metric | Outcome |

|---|---|

| Handling Time | ↓ 30% per case |

| Projected Operational Savings | > $500,000 annually |

| Compliance Risk | Significantly reduced |

| Duplicate/Spam Submissions | Nearly eliminated |

| Agent Satisfaction | Increased significantly (qualitative feedback) |

| Adoption of Process Flow | Used by other designers across teams |

Takeaways

- ✓Operational UX is just as critical as customer-facing UX—agents are users too.

- ✓Building logic-first design improved scalability and compliance.

- ✓Reusable frameworks (like my flow chart) helped elevate cross-team collaboration and workflow clarity.